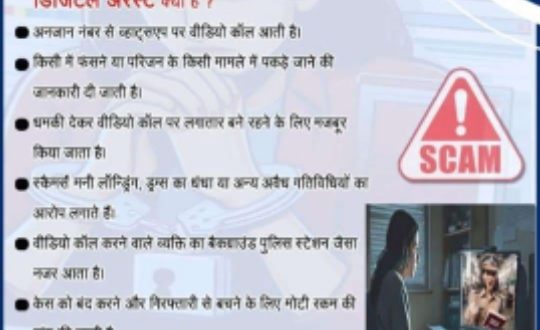

A customer of State Bank of India contacted a branch of SBI in Lucknow and informed that he did not bring a cheque book with him, so he wanted to send Rs. 10.00 lakhs by RTGS by issuing a loose cheque or using a debit voucher. During the conversation, he was constantly on video call and looked tense. Sensing suspicion, he was taken to the Branch Manager. The BM started talking to the customer and tried to find out the real reason for transferring the money, but the customer was not giving any information and was constantly on video call. After some time, the customer again said that he would no longer pay Rs. 10 lakhs but Rs. 40 lakhs through RTGS. Noticing the suspicious behavior of the customer, the branch manager expressed his inability to do RTGS without cheque and asked him to bring the cheque book with him. Soon, the branch received a call from the customer’s son asking that all the accounts of my father be frozen as his father had received a call from a fraudster who introduced himself as the DCP of New Delhi. The fraudster stated that his mobile number had been used for illegal purposes and asked him to deposit Rs 90 lakh in different accounts to twist the investigation. Thus, the branch staff, with their prudence, alertness, and proactive approach, saved the customer from being a victim of cyber fraud and thwarted the attempt to cheat Rs 90 lakh by digital arrest.

AnyTime News

AnyTime News